Teledyne to Acquire e2v

For the machine vision market, e2v provides high performance image sensors and custom camera solutions and application specific standard products. In addition, e2v provides high performance space qualified imaging sensors and arrays for space science and astronomy.

THOUSAND OAKS, Calif. & CHELMSFORD, England--(BUSINESS WIRE)--Teledyne Technologies Incorporated (NYSE:TDY) ("Teledyne") and e2v technologies plc (LSE:E2V.L) ("e2v") jointly announced today that they have reached agreement on the terms of a recommended cash acquisition to be made by Teledyne for the ordinary share capital of e2v by means of a Scheme of Arrangement (the "Offer"). Under the terms of the Offer, e2vs ordinary shareholders ("e2v Shareholders") will receive 275 pence in cash for each e2v share valuing the entire issued and to be issued ordinary share capital of e2v at approximately £620 million on a fully diluted basis. It is expected that, subject to the satisfaction or waiver of all relevant conditions, the acquisition will be completed in the first half of calendar 2017.

For the machine vision market, e2v provides high performance image sensors and custom camera solutions and application specific standard products. In addition, e2v provides high performance space qualified imaging sensors and arrays for space science and astronomy. e2v also produces components and subsystems that deliver high reliability radio frequency power generation for healthcare, industrial and defense applications. Finally, the company provides high reliability semiconductors and board-level solutions for use in aerospace, space and radio frequency communications applications.

"We have followed e2v for more than a decade. Over time, as both Teledyne and e2v evolved, our businesses have become increasingly aligned. In fact, every business within e2v is highly complementary to Teledyne. As important, there is minimal product overlap," said Robert Mehrabian, Chairman, President and Chief Executive Officer of Teledyne. "For example, we are both leaders in space and astronomy imaging, but Teledyne largely provides infrared detectors and e2v provides visible light sensors. While we both provide microwave devices, e2vs largest product and market are magnetrons for cancer radiotherapy. Teledyne supplies solid state and vacuum microwave systems, but no magnetrons, and we primarily serve defense markets such as electronic warfare, radar and communications. However, Teledyne serves the healthcare market with specialized X-ray sensors.

"In machine vision applications, e2vs advanced capabilities in proprietary CMOS sensor design add to Teledynes strengths in cameras and vision systems. While Teledyne designs advanced mixed signal circuits for government and commercial applications, e2vs broader product portfolio enhances our offerings and channels to market."

Neil Johnson, Chairman of e2v, commented, "Teledyne has recognized the value inherent in our business and prospects by making a cash offer at an attractive premium to the share price. The Board of e2v has also considered the merits of being part of a larger, complementary group with enhanced scale and a wider range of capabilities to service its key customers and management and employees having access to the opportunities available in a larger group. The Board of e2v is therefore unanimously recommending e2v Shareholders to vote in favor of the acquisition."

The aggregate enterprise value for the transaction is expected to be approximately £627 million (or approximately $789 million) taking into account e2v stock options and net debt. For the year ended March 31, 2016, e2v had sales of approximately £236 million. Excluding transaction-related expenses, Teledyne management expects the transaction to be accretive to earnings per share.

e2vs directors have unanimously recommended that e2v Shareholders vote in favor of the Offer. In addition, Teledyne has received irrevocable undertakings from e2v directors and irrevocable undertakings or letters of intent from e2v Shareholders representing approximately 46% of the entire issued ordinary share capital.

Teledynes Offer will be made in accordance with the relevant requirements of the UK City Code on Takeovers and Mergers ("Takeover Code") (including customary closing conditions) and be governed by English law. For additional information on the Offer please see documents available on www.teledyne.com and on the e2v website at www.e2v.com during the course of the offer process.

Investec Bank plc and N M Rothschild & Sons Limited are acting as financial advisors, and Macfarlanes LLP is acting as legal counsel to e2v. Teledyne is advised by Citigroup Global Markets Limited as financial advisor and Eversheds LLP as legal counsel. Teledyne has entered into a credit agreement with Bank of America, N.A., as administrative agent, and Merrill Lynch, Pierce, Fenner & Smith Incorporated, as sole bookrunner, to provide certain funds in connection with the transaction.

Teledyne is a leading provider of sophisticated instrumentation, digital imaging products and software, aerospace and defense electronics, and engineered systems. Teledyne Technologies operations are primarily located in the United States, Canada, the United Kingdom, and Western and Northern Europe. For more information, visit Teledyne Technologies website at www.teledyne.com.

Bringing life to technology, e2v partners with its customers to improve, save and protect peoples lives. e2vs innovations lead developments in automation, healthcare, communications, safety, discovery and the environment. e2v employs approximately 1,700 people worldwide, has design and operational facilities across Europe, North America and Asia, and has a global network of sales and technical support offices. For more information, visit e2vs website at www.e2v.com.

Notice to Non-UK e2v Shareholders

The Offer is not being made and will not be made, directly or indirectly, in or into the United States or in any other jurisdiction in which the making of the Offer would not be in compliance with the laws of such jurisdiction. Any and all materials related to the Offer should not be sent or otherwise distributed in or into the United States whether by use of the United States mail or by any other means or instrumentality of United States commerce (including, but without limitation, the mail, facsimile transmission, telex, telephone and the Internet) or any facility of a United States national securities exchange, and the Offer cannot be accepted by any such use, means or instrumentality, in or from within the United States. Accordingly, no materials related to the Offer will be, and must not be, sent or otherwise distributed in or into or from the United States or, in their capacities as such, to custodians, trustees or nominees holding shares of e2v for United States persons, and persons receiving any such documents (including custodians, nominees and trustees) must not distribute or send them in, into or from the United States. Any purported acceptance of the Offer resulting directly or indirectly from a violation of these restrictions will be invalid. No shares of e2v are being solicited from a resident of the United States and, if sent in response by a resident of the United States, will not be accepted. For the purposes of this paragraph, United States means the United States of America, its territories and possessions, any state of the United States of America and the District of Columbia.

The availability of the Offer to e2v Shareholders who are not resident in and citizens of the United Kingdom may be affected by the laws of the relevant jurisdictions in which they are located or of which they are citizens. Persons who are not resident in the United Kingdom should inform themselves of, and observe, any applicable legal or regulatory requirements of their jurisdictions. Further details in relation to non-UK shareholders will be contained in the Offer documentation.

Neither the United States Securities and Exchange Commission nor any U.S. state securities commission has approved or disapproved the Offer or passed upon the completeness of this announcement or the Offer documentation. Any representation to the contrary is a criminal offense.

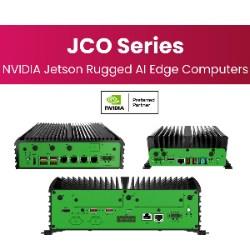

Featured Product